|

Welcome to the world of on-demand business software. You could be issuing invoices today!

|

Products » BT3 Accounting » Key Features

| Invoicing | Customer Relationship Management | Accounting | All-in-One Enterprise Suites |

Franchise Suites | Software for Accountants |

Key Features in BT3 Accounting

|

SmartPanelsA quick view of your current financial situation. There are SmartPanels for key financial indicators. There are also dedicated SmartPanels for customers and invoices, and suppliers and purchases. |

|

Simple Interface for Invoices and Credit NotesWith SMARTEDGE you get a simple and straight-forward interface to create invoices and credit notes. Credit Notes can easily be created automatically from the original invocie without re-entering any data. With SMARTEDGE you can memorise invoices for later invoicing. Simply capture the invoice information and then save it as memorised. When the invoice should be issued, simply open the invoice and make the necessary changes and an invoice document can be created and e-mailed on the fly. One-click action to produce professional looking Tax Invoices in PDF format. All documents can be e-mailed to your customer, rather than printed. |

|

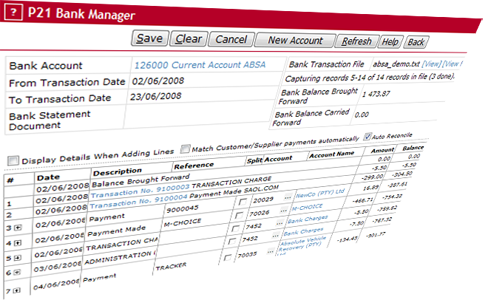

Powerful Bank Manager for your Cash BookSMARTEDGE offers a powerful, yet easy to use, Bank Manager to capture all your money transactions. The bank manager can automatically capture payment transactions from electronic bank statements downloaded from your internet bank. In the bank manager you can capture payments manually or you can let the bank manager automatically process bank statements with reference recognition. The reference recognition feature will identify and allocate who a payment was made from or to based on the bank's transaction description. The bank manager also includes the option to view transactions already captured in a given date range. This enables you to easily identify whether a payment already has been captured. |

|

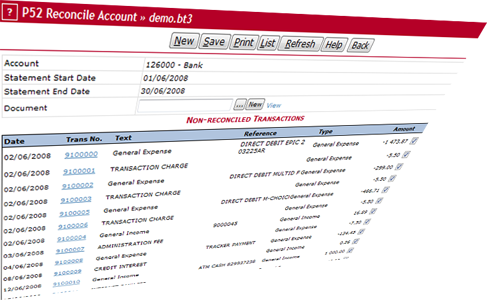

Easy ReconciliationWith SMARTEDGE bank reconciliation becomes a hassle-free experience. Whether you use the bank managers auto reconciliation feature or manually reconcile your bank accounts, you will at all times be sure that your bank is in order. The Bank Manager has the option to automatically reconcile a bank account that balances with your bank statement. Alternatively, you can easily reconcile bank and cash accounts manually. Manual reconciliation lists all transactions and allows you to mark off payments that match the bank records. |

|

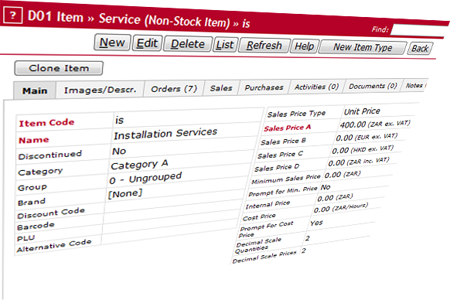

Customers, Contacts and ItemsStore your customers and contacts for re-use. You can also create different product services to track sales of individual items, offering you superb understanding of what you are selling and who you are selling it to. Storing and re-using this information removes any errors that often occur if you use a manual based system, for example invoicing using Excel. It also makes you much more efficient since you can quickly and easily add products and services to your invoices. |

|

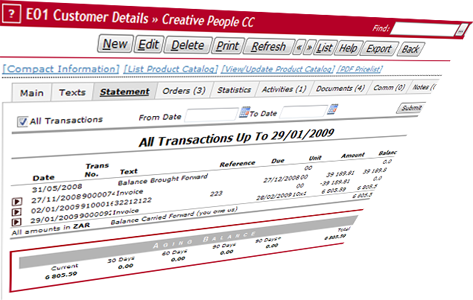

Accounts ReceivableTracking customer invoices and payments is easy with SMARTEDGE. Aging Balance reports give you full overview of your accounts receivable and you can easily produce mass statements that can be e-mailed as PDF documents to your customers. Getting the payment in is just as important as getting the invoice out. With SMARTEDGE Accounting you get customer statements with age analysis of outstanding payments. Tracking payments properly makes it effortless to send statements to customers, either on a regular basis or when a customer request as statement. Your business will look much more professional, and you will have more control over your money. |

|

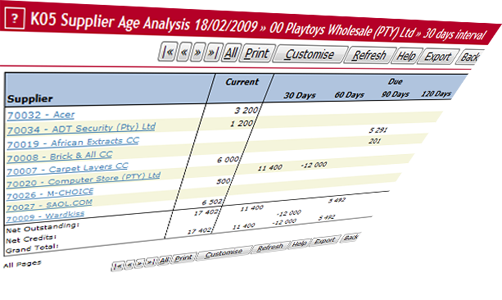

Accounts PayableKeeping your Accounts Payable in order is simple. SMARTEDGE allows you to capture supplier invoices with payment due date. The Supplier Age Analysis tells you at a glance when you need to make payments. |

|

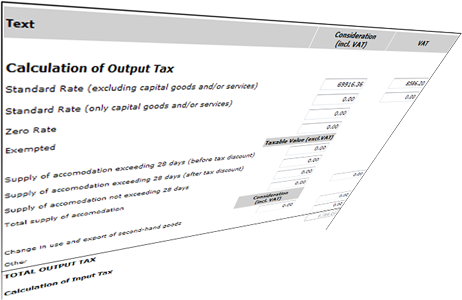

Value Added Tax HandlingSMARTEDGE tracks all your VAT transaction for you without you needing to worry about it. At the end of the VAT period a VAT return is automatically created in the format required by SARS, for your easy transcription to SARS' VAT submission form. VAT is handled using VAT codes which allow you to determine the type of VAT handling a particular transaction should use. Accounts and items have default VAT codes. This means that you rarely need to make changes to the VAT handling for a particular transaction, while it leaves you the option to select different VAT handling when required. Every VAT Return includes a VAT audit report where you can review exactly which transactions are included on the VAT return. |

|

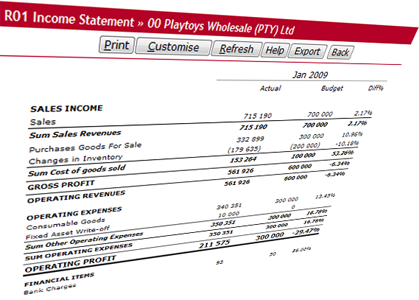

Financial StatementsIncome Statements, Balance Sheets and Cash Flow Statements can be produced for any time period at any time. Income Statements can be produced with budget figures to compare how your business is performing against budgeted targets. |

|

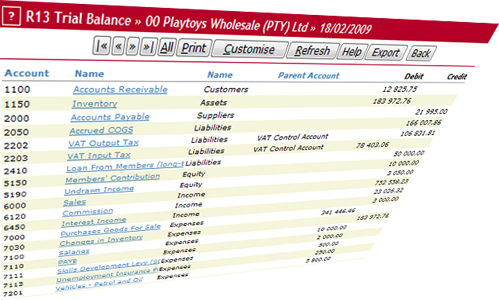

ReportsEasy to read reports give you full view of your invoices, financial transactions, general ledger and trial balance. The reports can be customised to view data for different time periods. Some of the important reports you get are:

|

|

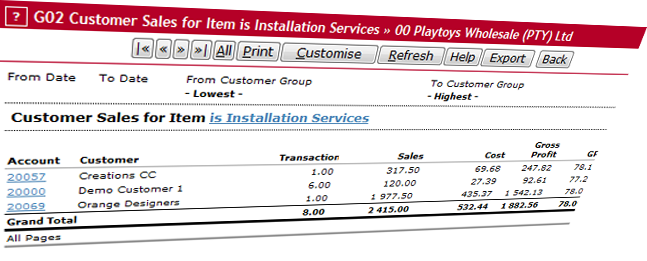

Sales and Profitability StatisticsWith SMARTEDGE you can produce statistics showing total profitability, or sales and profitability by customer or products/services. You get the following sales statistics reports:

|